In the hustle and bustle of city life, there’s a palpable rhythm. Just as a taxi meter keeps ticking, reminding us that time is of the essence, tax deadlines in the U.S. operate with the same relentless punctuality. Miss them, and just like a forgotten taxi fare, you might end up paying a price. Let’s navigate the streets of U.S. tax deadlines together, ensuring you always arrive on time.

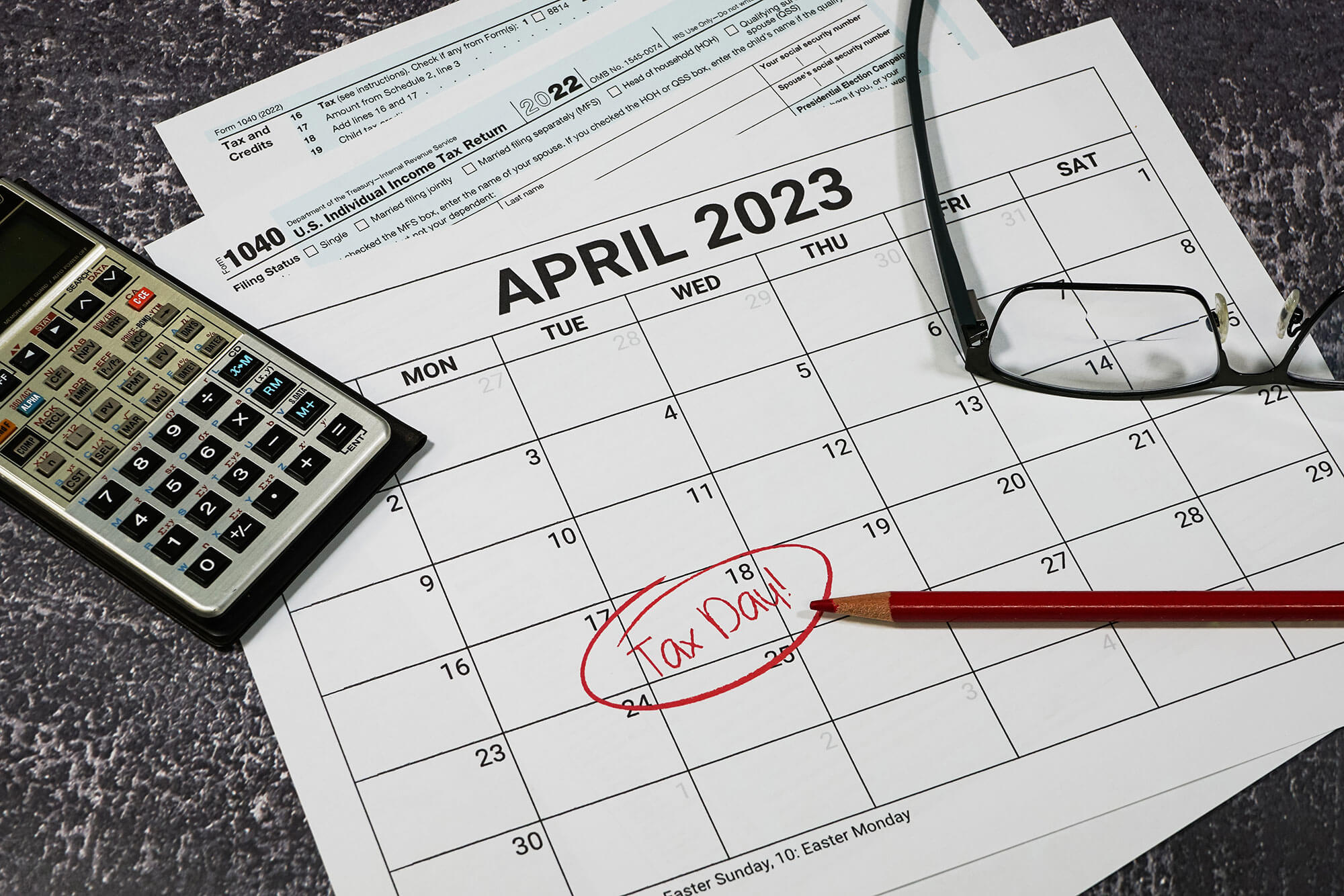

Our first stop is April 15th. Known widely as ‘Tax Day,’ this date is imprinted in the minds of many Americans. By this day, most individuals are expected to file their federal income tax returns for the previous year. But, much like traffic on a Friday evening, there are occasional exceptions. If the 15th falls on a weekend or holiday, the deadline might extend to the next business day.

Next, we steer towards Estimated Tax Payments for those who have income not subject to withholding. These payments are due in four installments throughout the year: April 15th, June 15th, September 15th, and January 15th of the following year. Consider these the periodic pit stops, ensuring your tax journey remains smooth.

For businesses, the tax landscape is a sprawling cityscape with various destinations. Corporations typically have their tax returns due on April 15th for calendar-year corporations. However, those on a fiscal year will need to file by the 15th day of the fourth month after their fiscal year ends. Partnership returns, on the other hand, are due on March 15th. For entrepreneurs, it’s essential to keep track of these dates as diligently as a cabbie monitors their routes.

While federal tax dates are crucial, don’t forget about the state tax deadlines! Each state may have different timelines and requirements. It’s akin to understanding local traffic rules; what applies in one place might differ in another. Ensure you’re aware of your state’s specifics to avoid any last-minute detours.

Lastly, it’s worth noting that extensions can be a saving grace. If you find that the meter’s ticking too fast and April 15th is looming large, you can request an extension to file. However, remember that an extension to file is not an extension to pay. It’s a bit like asking your taxi driver to wait—it buys time, but the meter keeps running.

In the end, understanding tax deadlines is about more than just dates; it’s about pacing oneself, planning ahead, and recognizing that, much like a taxi ride through the city, there will be stops, starts, and occasional surprises. By staying informed and prepared, you can ensure that when it comes to taxes, you always reach your destination without a hitch.